With more and more accidents, natural disasters, and claims insurance rates are likely to go up. Questions we should be asking are how much and what can we do?

The Data

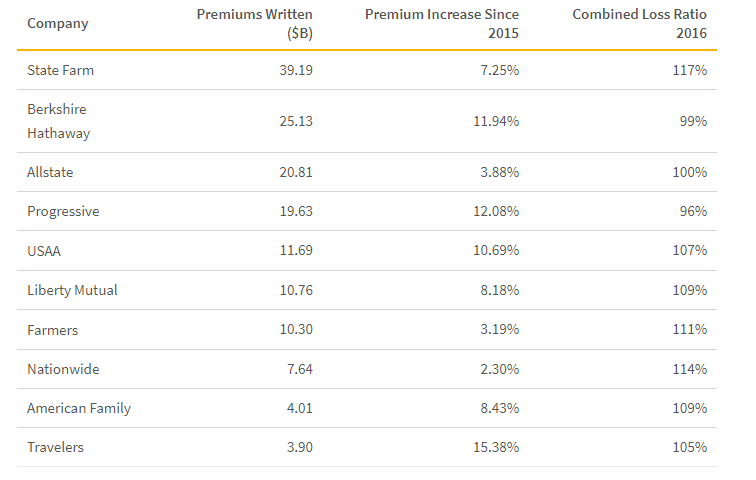

Valuepenguin’s researchers have done an excellent job of gathering data on different companies and their rates. Along with the combined loss ratio which would project possible a possible rate increase. When I reached out to them to verify their data they speedily and professionally confirmed the validity of this data. The following paragraph is a snipped from their website.

Why Are Auto Insurance Rates Continuing to Climb?

Like any business, companies need to sustain higher revenue than expenses in order to stay viable. Auto insurance is no different; companies make money off of the premiums customers pay, but lose money when they fulfill their obligation to pay for their customer’s damages. They also have a host of operating expenses to pay, including agent compensation and advertising.

The proportion of expenses to revenue is called the “combined loss ratio,” and whenever it is above 100%, the company loses more money than it is earning. In 2016, only two of the top 10 auto insurance companies in the country had combined ratios below 100%—and just barely according to ValuePenguin Inc.

To the right you will see a snapshot of some of the data that is available. It contains a list of some of the major insurance companies. Their premiums written, premium increases and their loss ratio.

Check out more of their charts & full article below,

https://www.valuepenguin.com/2017/05/auto-insurance-rate-hikes-also-likely-2018

What does this mean for you?

This could mean a possible rate increase of not only Auto Insurance but for other policy types such as Homeowners, Renters, Valuable Items, Boat, RV, and cannabis as well. Don’t be blindsided when these changes occur we’re here to help.

Possible Solutions:

Call Insurance West – As an independent insurance agency we have many Home, Auto, Boat, insurance carriers including umbrella markets to tailor insurance coverage for you individually or the family. Often, we can bundle insurance policies together for even more savings.

A few minutes could save you thousands!

Contact Brian at,

253.475.7700

brian@insurancewestinc.com

Insuranceforcannabis.com